Established

1998

Franchise Units

50

Minimum Investment

$150,000

Franchise Fee

$25,000

Total Investment Range

$350,000

Home Based

No

Description

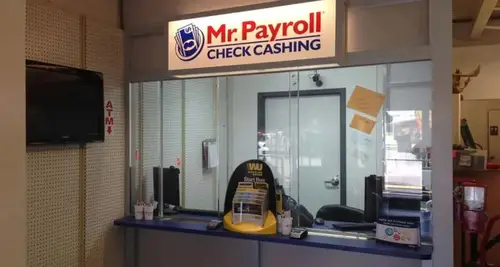

Mr. Payroll Check Cashing is a well-established money services franchise built to serve everyday Americans who rely on fast, accessible, and trustworthy financial solutions. Positioned within the high-demand alternative financial services sector, the brand specializes in payroll check cashing, government and tax refund checks, money transfers, bill payments, prepaid debit cards, and other essential financial transactions.

Unlike traditional banks that often overlook underserved communities, Mr. Payroll Check Cashing fills a critical gap by offering convenient, face-to-face services with transparent pricing and rapid turnaround times. Its storefront-based model thrives in dense urban corridors, working-class neighborhoods, and commercial districts where foot traffic is strong and recurring customer visits are common.

For entrepreneurs and investors seeking a recession-resilient, service-driven business with steady daily cash flow, Mr. Payroll Check Cashing offers a proven operating framework, established brand recognition, and multiple revenue streams under one roof. The franchise’s straightforward operations, minimal staffing requirements, and repeat-use customer base make it a compelling opportunity in today’s evolving financial landscape.

Why Invest in This Franchise?

Investing in Mr. Payroll Check Cashing means entering a sector that remains in demand regardless of economic cycles. People continue to need access to their earnings, government benefits, and financial services whether the economy is booming or tightening.

Key reasons investors choose this franchise include:

-

Essential services business with year-round demand

-

High repeat customer frequency (weekly and bi-weekly visits)

-

Multiple income streams under one location

-

Lower overhead compared to many retail franchises

-

Strong community trust and local brand loyalty

-

Opportunity to scale into multiple locations

Background

Established Year: 1998

-

Founders: Industry professionals with extensive experience in alternative financial services

-

Industry Category: Financial Services / Money Services Business

-

Franchise Active Units: 50+ locations across the United States

Brand Journey & Company History

Mr. Payroll Check Cashing was founded to provide accessible, transparent financial services to individuals and families underserved by traditional banks. What began as a single neighborhood operation quickly gained traction through trust, speed, and fair pricing.

As demand increased, the company invested in secure transaction technology, compliance systems, and standardized operating procedures. The brand expanded through franchising and now operates across multiple U.S. states while maintaining strict regulatory compliance and a strong customer-first approach.

The company remains privately owned, with a long-term focus on franchisee success, operational stability, and responsible growth.

Support Training

Mr. Payroll Check Cashing offers comprehensive support covering every stage of franchise ownership.

Pre-Launch Support

-

Territory evaluation and site selection guidance

-

Lease and location layout recommendations

-

Licensing, compliance, and regulatory assistance

-

POS systems and transaction software setup

Initial Training

-

Hands-on operational training

-

Regulatory compliance education (KYC, AML, MSB standards)

-

Cash handling, fraud prevention, and risk management

-

Customer service and daily workflow training

Marketing & Business Support

-

Grand opening marketing guidance

-

Local advertising and community outreach strategies

-

Branded signage and promotional materials

Ongoing Support

-

Dedicated franchise support team

-

Operational audits and performance reviews

-

Ongoing training updates and compliance support

-

System and technology enhancements

Ideal Candidate

Mr. Payroll Check Cashing is best suited for disciplined, service-focused entrepreneurs.

Ideal Candidates

-

First-time business owners seeking a structured franchise model

-

Multi-unit operators in retail or service businesses

-

Investors comfortable managing cash-based operations

-

Community-oriented entrepreneurs

Key Skills & Traits

-

Strong attention to detail and compliance

-

Basic financial and cash management skills

-

Customer service mindset

-

Ability to manage daily operations and staff

Location Preference

-

Urban and suburban areas with high foot traffic

-

Working-class neighborhoods and employment hubs

-

Retail corridors near transit routes or commercial centers

Financial Detail

| Financial Component | Estimated Amount (USD) |

|---|---|

| Total Investment Required | $150,000 – $350,000 |

| Minimum Investment Required | ~$150,000 |

| Franchise Fee | $25,000 – $35,000 |

| Leasehold Improvements & Build-Out | $40,000 – $90,000 |

| Equipment & Technology | $20,000 – $40,000 |

| Initial Marketing & Signage | $10,000 – $20,000 |

| Initial Working Capital | $30,000 – $80,000 |

| Royalty Fee | 5% – 7% of gross revenue |

| Marketing / Brand Fund | 1% – 2% |